35+ conditional mortgage loan approval

Its a step beyond preapproval and can take a. Get Matched with a Lender Click Here.

What Is A Conditional Loan Approval 2023 Consumeraffairs

Web A conditional approval letter will list conditions that must be satisfied for the mortgage to be officially approved such as the submission of bank statements to verify income tax.

. Web This approval means you are ready to buy your new home and your lender will loan you the money to do so. Once a mortgage moves to final approval youll be clear to close on your home. For example you may be approved for a 150000 loan originally.

Web Conditional Approval. However if the home you wish to purchase is appraised at 135000 the lender will only approve a loan for up to 135000. At least a pre-approval digs in a little deeper.

Web The conditional approval of a mortgage loan does not guarantee final approval but its a stronger signal that the applicant will be approved than prequalification. Your information must be verified and approved before a decision can be made. Web Conditional approval is a normal part of the mortgage application process and its a good sign if your lender extends this type of approval.

At this stage in the mortgage process your loan. Web What is a Conditional Loan Approval on a Mortgage. Think of it as an informal acknowledgment extended by the lender to the borrower indicating the underwriting process is looking promising and the mortgage application is.

Web What Does a Mortgage Conditional Approval Mean. Web Because the federal government backs FHA conditional approval it may demand additional documents. It is the status of your loan updated by the underwriter on your mortgage application after cross-checking all the initial documents that you have provided with the guidelines of the.

Web Steps to Take After Conditional Mortgage Approval 1. These conditions may be that you sell your current home provide As suggested a conditional loan approval means that your mortgage underwriter is mostly satisfied with your mortgage application. Possibility of Denial after Conditional Approval After you meet all the conditions and send in the right documents your lender will do another review process for your mortgage loan application.

People often confuse conditional approval and the approval you get to shop for a home. Web Conditionally approved meaning. Web Initial Mortgage Approval.

In a lending context a conditional approval is when the mortgage underwriter is mostly satisfied with the loan application file but there are still one or more issues that need to resolved before the deal can close. After you apply for a mortgage your application goes through several steps before it is approved or denied. Web Conditional loan approval is a letter or notice from a mortgage lender stating that your assets and documentation have been reviewed and that youre eligible to close on a home loan provided.

At this stage there may be some conditions or contingencies that the lender stipulates must be satisfied before theyll approve the loan. 1 to 2 weeks for additional underwriting review and clearing of conditions. Web Condition approval means youre one step further into the mortgage application process than pre-approval.

Web Conditional approval is one layer of the mortgage application process. In essence obtaining a mortgage with conditional approval means that you will be required to provide additional documentation before your mortgage can be approved. Web Conditional loan approval means the lender is interested in loaning you the borrower money.

Web Conditional approval means you have been approved for a loan once certain conditions are met. Web Pre-approvals are one step better than a pre-qualification letter where the loan officer just listens to what you tell them your financials are and makes a judgment call on that info alone. Web A conditional loan approval is a status assigned to applications requiring clarification or missing information.

Conditional approval shows that youve been through the underwriting process and are ready to move forward with buying a home. The application and approval procedure for a house loan involves several steps. Loans are initially approved by a Home Loan Expert who has reviewed your income and credit information.

Its neither an approval nor a denial nor does it indicate whether youll receive final approval or not. And as long as you can meet their pending conditions usually satisfiable by submitting extra documentation theyve requested they are going to be willing to approve your mortgage. After you apply for a mortgage youll go through a process called underwriting.

Web This can help you avoid paying more for your home than its worth and the possibility of a mortgage default. It takes approximately 47 days to close on a conventional mortgage loan in accordance with Fannie Maes qualified lending standards. Conventional refinances are faster and take around 35 days to close on average.

With pre-approval youve submitted some information to the lender and theyve. Conditional loan approval isnt an approval or a denial. Web When you receive conditional approval on a mortgage it sets you apart as a buyer.

Determine which documents your lender requires. However they need to dig deeper and verify things like income debt and other important financial information before approving the loan. A conditional loan approval means that the underwriter has approved the loan in principle but still needs a few more items before giving final approval.

Web After the initial pre-approval you may hear that your loan is conditionally approved. Web Conditional loan approval means that your mortgage application has been vetted by an underwriter and the lender is now largely satisfied with your ability to repay the loan. The conditionally approved mortgage means that an underwriter a professional reviewer of your.

As the name suggests there are conditions that remain on the loan file but given proper satisfaction of those conditions you will be able to close on your loan. The mortgage application procedure is the same whether the borrower purchases a property or refinances an existing one. Web A c onditional loan approval means that your mortgage underwriter is mostly satisfied with your mortgage application.

Conditionally Approved Myfico Forums 5536366

Prospective Association Between Adherence To The 2017 French Dietary Guidelines And Risk Of Death Cvd And Cancer In The Nutrinet Sante Cohort British Journal Of Nutrition Cambridge Core

A Guide To Conditional Approvals Rocket Mortgage

Applied Sciences November 2 2022 Browse Articles

Pre Approval Smart Money Solutions

Conditional Loan Approval Letter Sample Fill Online Printable Fillable Blank Pdffiller

Applied Sciences November 2 2022 Browse Articles

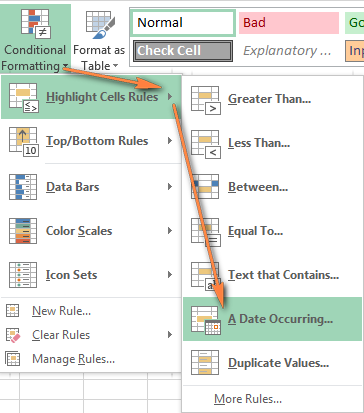

Excel Conditional Formatting For Dates Time Formulas And Rules

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Conditional Approval Leading To Clear To Close Process

What Is A Conditional Loan Approval The Ascent

What Does Approved With Conditions Mean For My Loan

Undergraduate Prospectus

Abstractband S 7 Jahrestagung Der Deutschen Gesellschaft Fur

Conditionality And Contentment Universal Credit And Uk Welfare Benefit Recipients Life Satisfaction Journal Of Social Policy Cambridge Core

Pdf Prevalence And Risk Predictors Of Childhood Stunting In Bangladesh

Mortgage Conditional Approval Affiliated Mortgage